50% of small businesses fail after their fifth year.* To beat the odds of business failure, you need to have fully up-to-date financial information.

Gone are the days when you could get away with throwing everything in a shoebox and dropping it off to an accountant the night before your tax returns are due.

Now is the time to track your money.

What a lack of tracking looks like.

Tracking money rarely feels urgent day-to-day, it only becomes pressing when there is a problem.

When you track your money, you can make important business decisions while there is still time to do something about it.

These are common challenges small business owners face when they don’t track their money:

- Bounced checks.

- Not enough funds for payroll.

- Long-overdue accounts receivable.

These problems are often caused by a lack of current financial data.

“Businesses always have problems. Numbers tell you where the problems are, and how worried you should be.”

Jack Stack (the Great Game of Business)

What’s the best way to track?

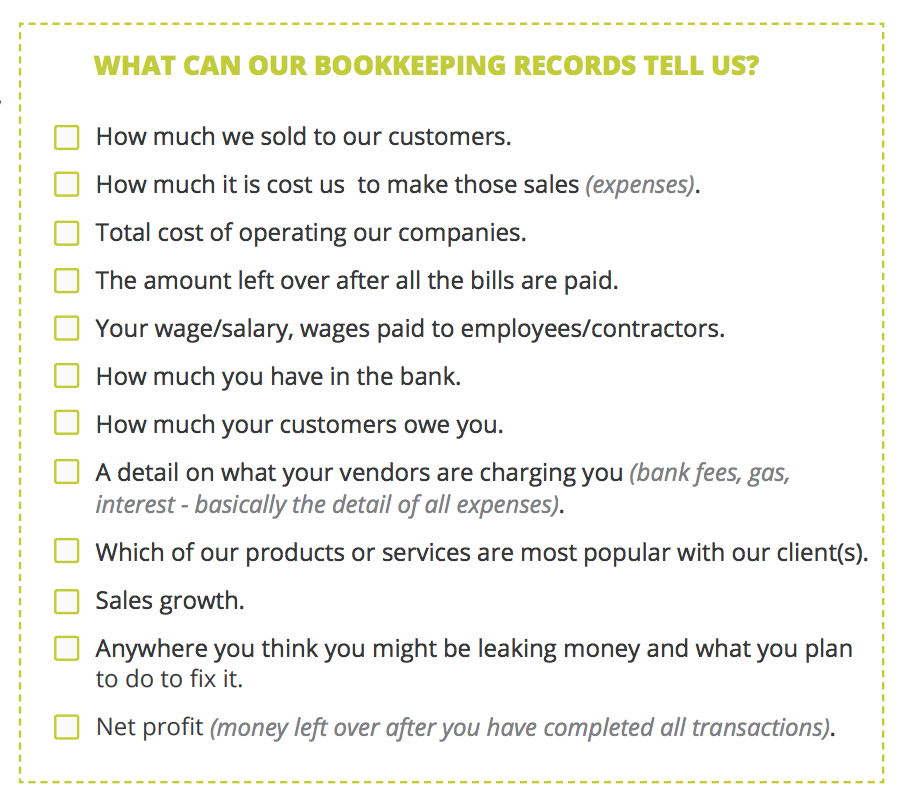

Look to your books! Your bookkeeping records are the best way to know what you need to track.

The data collected from financial records gives us insight into how we can best run our companies.

The way you set up your books, specifically, your chart of accounts will determine if the information you collect is valuable or not.

Use the checklist below to review what you’ve tracked and what’s has the biggest impact on your business.

Now, maybe you went through this checklist and after looking at your books, you found that some customers slipped through the cracks— you are missing payments from them!

So, how can you fix this broken system?

One of you biggest things you can do is adjust the information you are recording.

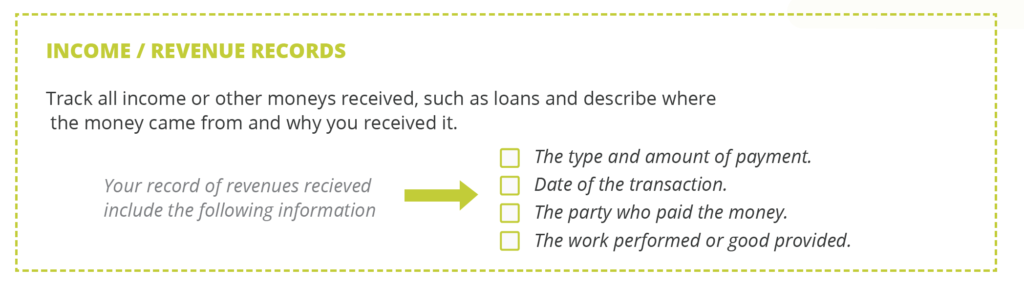

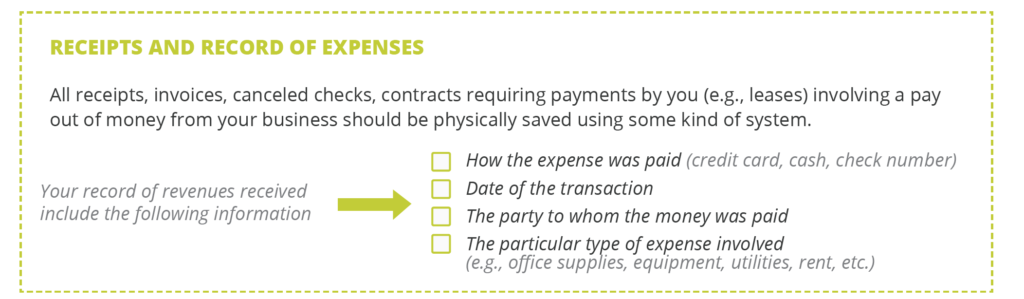

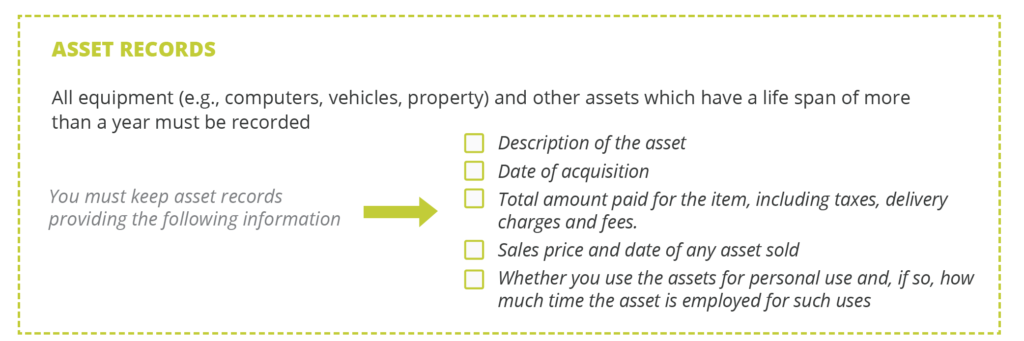

What do you need to record?

Having accurate up to date books gives you information, and information is power. It allows you to make sound business decisions quickly.

I encourage you to do whatever it takes right now to put yourself in control of your business finances.

It starts with tracking your money, all of it, on time, all the time, no matter what.

Here’s the information you need to record to accurately track your money:

Being a bookkeeper

You might find recording your finances difficult. Especially if you struggle with math, paperwork or numbers. (And that’s okay, it’s not an easy task to being with!)

There might be a little voice in your head whispering ” Do I have to do my own bookkeeping?”

This is a valid question! And it depends on:

- If you like doing it.

- If it is the best use of your time.

- You are able to do it accurately and keep things fully up to date at all times.

As the leader of your company, you decide where your time is best spent. And if bookkeeping is frustrating, boring or time-consuming, you can hire someone who can track money better than you can.

Work with your accountant or ask another small business owner to get a recommendation for a great bookkeeper. This is likely the single most important person you hire … ever!

If you don’t have an accountant that you love and trust completely, then now is the best time to start shopping for one. Try to start interviewing accountants before tax season, because by then they may be too busy to talk.

Be sure you are comfortable asking potentially “stupid” questions until you fully understand their responses. Hiring an accountant requires the same care as hiring an employee. Take your time and be comfortable with the decision.

And it’s important that you still know what’s going on with your financial records, even after you have an accountant.

Knowing your financials means you, and no one else, is in charge of your business.

Track your money!

Financial records, when fully up to date, are the road map to profitability.

Setting up your tracking system is going to take time and patience. And the results are going to be worth it.

Tracking your money can be hard.

Yet, not tracking your money as a small business owner is harder.

It feels freeing to not worry about money anymore because you know exactly where your financials lie. Plus, you tend to have more money once you start tracking it.

If you need help organizing your business finances, let me know in the comments. I have a few good resources to recommend that I know and trust.

Until next time, enjoy your Entrepreneurial Journey!

Sources

*Survival of private sector establishments by opening year. (2020). [Dataset]. U.S. Bureau of Labor Statistics Latest Numbers. https://www.bls.gov/bdm/us_age_naics_00_table7.txt