Have you noticed your suppliers are raising their prices? Is the cost of operating your business starting to rise? What you’re experiencing is inflation.

Here’s an example of inflation I’ve seen recently. It was common even a year ago to have a housekeeper charge $25 CAD per hour, now the going rate is $40 CAD. Why did it go up so much? The cost of operating a business has increased (supplies, gas, rent, utilities) and the cost of living has gone up (groceries, rent, clothes, entertainment).

Chances are you’ve been busy. So busy that you may not have noticed the small changes that have increased the costs of your business. If you aren’t watching these can compound and suddenly your operational costs and cost of goods sold will be out of alignment. Your profits won’t be enough to cover your expenses.

The question becomes, what are you going to do about it? How will your business survive the effects of inflation while still providing a healthy, prosperous life for you, your employees and your family?

Table of contents

Look at your income statement

This valuable document may have the answers you need. Go through your previous income statements from this year. Really dig in and look at the details, line by line. Did your rent go up since January? What about the price of gas? What expenses have changed since 2021?

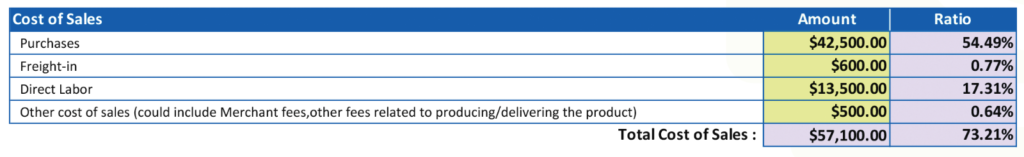

You can clearly see how inflation affects your business by looking at the costs of goods sold (COGS) and operating costs on your income statement.

Cost of goods sold

What is it?

All expenses you incurred to obtain, create and deliver the product or provide the service. This includes money spent on inventory, and direct labour (team members doing work to make things or directly serve customers). If you had no customers in this period there would be no costs in this section of the income statement.

Where is it on your income statement?

You can usually find this information under the heading “Cost of Sales”

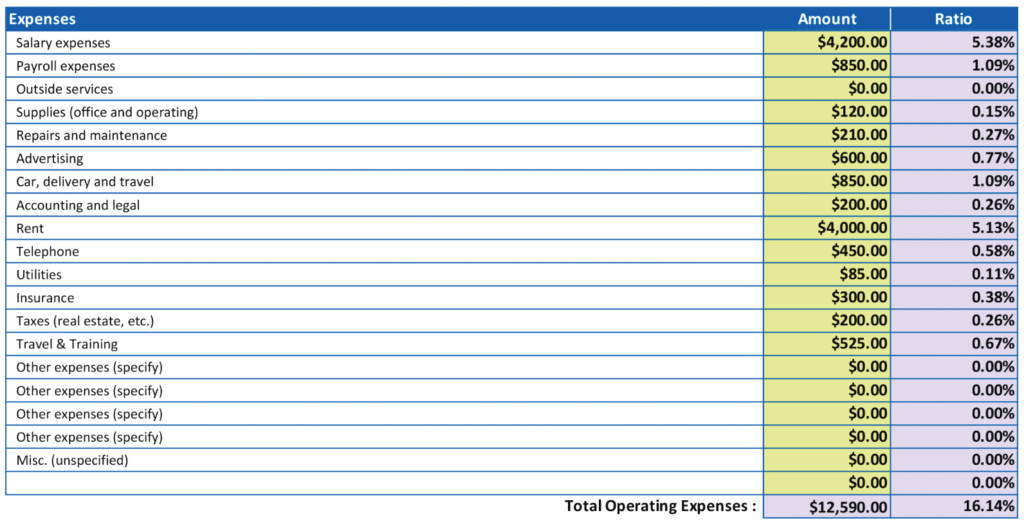

Operating costs

What is it?

All the costs related to running your business even if you did not make a sale. This includes things such as rent, phone, marketing expenses, management salaries, administration costs, supplies and money spent on training. Basically, it’s everything related to the day-to-day running of the company.

Where is it on your income statement?

You can find this under “Expenses”.

Set aside strategic time

What’s another way to stay ahead of inflation? Set aside 5 hours to do a full audit of what’s going on in your business. I recommend conducting 5 hours of strategic work every week— and now is an especially important time to have a close look at what’s going on in your business.

To survive the effects of inflation, have you strategically considered the following:

- What suppliers you are working with? Is there a supplier that has a better deal for the same quality? Or can you re-negotiate with your current supplier?

- What are your competitors doing? Chances are they’ve already increased their prices due to inflation. You don’t want to get left behind!

- Hiring a business coach. Would it help to have a trusted partner to talk through complex issues and persistent problems?

- Have you reviewed your discount policy? Are you offering discounts that aren’t profitable?

- Have you checked in with your employees? Are they motivated and inspired to be the most productive they can be?

- What are your thoughts about raising your prices? Do your profits outweigh your expenses?

Don’t sell through someone else’s pocket

When raising your prices to survive inflation, don’t sell through someone else’s pocket. Just because you can’t afford it doesn’t mean someone else can’t.

Here’s a story from my time running my travel agency. We were offering three different travel packages that varied in price. My employee gave two out of the three package brochures to a customer because my employee assumed the third one was too expensive for the customer.

The customer called me the next day… and she was angry! She felt offended that my employee thought it was too expensive for her.

“I’ll decide what’s expensive!” she huffed.

This was a big lesson for me. It’s up to the customer to decide what’s expensive. You never know other people’s money situations.

Share with like-minded business owners!

Reflect on your money story

What’s your money situation?

Inflation affects businesses beyond the money we see on paper. It also brings up our emotional relationship with money.

Everyone has a story surrounding money. How we feel about money, how we respond to money, and how we talk about money is deeply personal. Here’s an example from James, who gave me permission to share his story.

When James was four years old, his dad walked out on his mom, leaving the family with limited resources. Being the eldest, he was called the “man of the house” and was expected to keep things together.

For the next twelve years, James took seriously his responsibility to take care of his mom and younger brother. He started earning money very young by collecting bottles and doing chores for others, and when he was seven he started delivering papers. James never kept anything for himself. He was poor and proud.

Fast forward forty years and James is still working hard and not keeping anything for himself. Every time his company starts to earn a profit, he in some way sabotages the win and goes back to his comfort zone of always being in a place of scarcity and lack.

How does your money story affect your response to inflation in your business? It may make you feel sick to your stomach to tell your clients you have to raise your prices. Maybe you feel greedy for increasing your revenue. These feelings are valid. And I ask, if not to make money, what is this business for?

If you’d like, you can read You’re a Badass with Money by Jen Senturo. You may find this book helpful for uncovering your money story and positively changing your outlook on money.

Change the perceived value of your work

Recently I was talking with a business owner and they asked me, “How can I justify raising my prices?”

It’s tough to tell customers your prices are changing. Often we feel we need to justify the change not just to them, but to ourselves.

One way to do this is by looking at your business equity. How can you change the perceived value of your work? Consumers will pay for what THEY value. When setting a price, the business owner must be aware of the customer’s perceived value for the product.

Think about pay equity. Get together with your peers and see if as an industry you can raise prices.

Is there gender equity in your business? If you’re a woman offering a product/service in a field dominated by men, maybe it’s time to look at that as well. Often women have something just as valuable but charge less.

Equity means changing the perceived value of your work. How can you change yours?

So how do you survive inflation in business?

Get comfortable with being uncomfortable. I know you’ve probably heard that before and now is the time to really embrace it. If you want to survive the effects of inflation, you need to be strategic, reflective, innovative, and bold. And I know you are all those things due to the fact that you opened a business in the first place.

And who knows, maybe by strategically looking at how inflation affects your business, you may find an opportunity to raise your prices more than you thought possible.