Looking at your balance sheet can be comforting or terrifying.

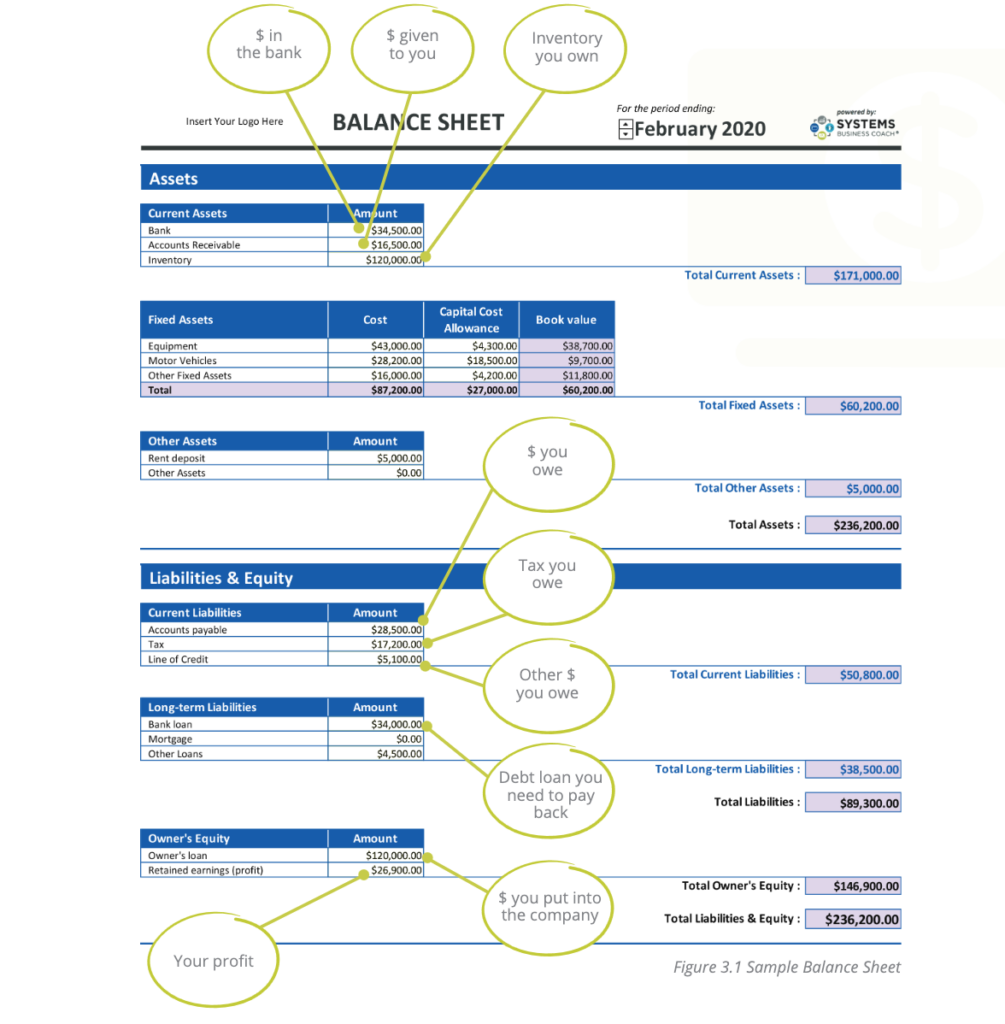

The balance sheet shows the financial position of your business. It tracks your assets, liabilities, and equity. In plain language, it shows what you own, what you owe, and how much money you’ve invested into the company.

It’s the first report your banker looks at when you apply for a loan. All those nasty credit card balances along with any unsellable or bloated inventory value plus the money you borrowed from the company… they’re all right there for everyone to see.

Reading your balance sheet

The balance sheet is divided into two sides. On the left, you will find all the company assets, and on the right are the company liabilities and owner’s (shareholder) equity.

As the name indicates, your balance sheet must balance. If it doesn’t, you have an error to fix. Your balance sheet contains your assets, which must equal your liabilities plus equity.

On your balance sheet, you will find:

- your bank account balances

- amounts owed on your credit cards

- loan balances.

If you’ve given credit to your customers, their balances due to you are on this report. If you purchased equipment, the value of these items is shown here.

Your owner’s equity on your balance sheet increases when profit shows up on the income statement. If you put your own money in to start the company, the balance sheet tracks those funds. If you paid yourself a dividend instead of a wage, this is where you will find those details.

When a business shows a profit on their income statement but they have no cash, we can find out what happened to the money by looking at the balance sheet. Cash can get used to pay debt, purchase capital assets or pay back a shareholder loan.

Balance sheet example

Until next time, enjoy your Entrepreneurial Journey!

The Small Business Field Guide

This blog highlights only a few of the skills small business leaders need to run a profitable business. If you want to learn more, grab a copy of the Small Business Field Guide.

This guide covers everything you need to know to have a prosperous business. Including how to read your income statement and statement of cash flow!