New entrepreneurs are often surprised by just how expensive it is to build and run a business. Without careful planning, your start-up money can evaporate before you have had a chance to make your first sale.

To prevent this, know and understand the full start-up costs for your small business. Plan for every dollar you need to spend and fiercely protect your start-up capital. The cost of starting your business will vary depending on many factors. Every business is unique.

Even if you plan on “volunteering” for a period of time, include the cost of a fair market wage for you in your calculations. Plan for the business to provide you with this wage AND make a profit.

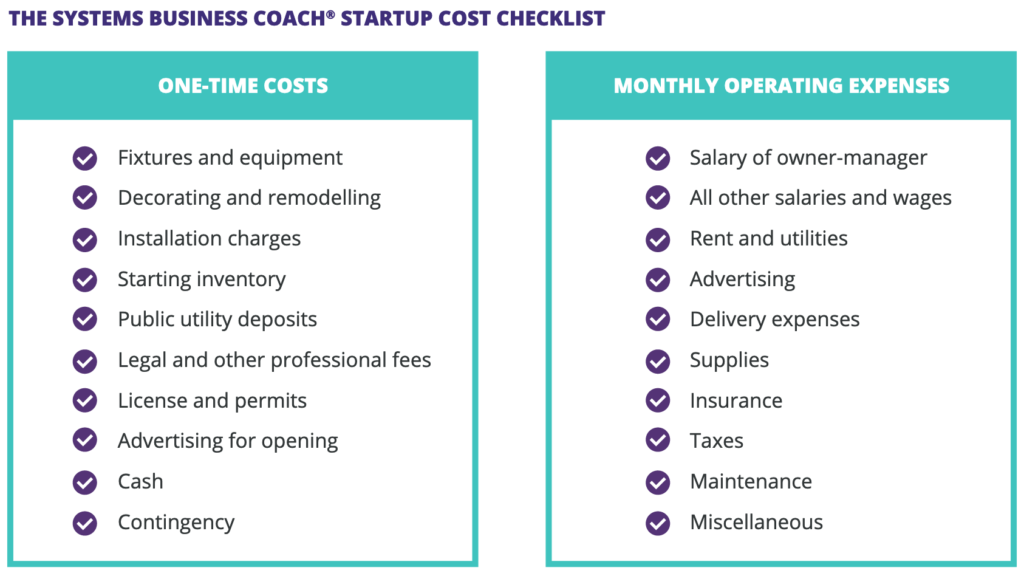

Knowing your small business start-up costs means knowing your one-time costs and your reoccurring monthly expenses.

Hate math?

Now is the time to reconsider that position and build a new relationship with numbers. Love it or hate it, math and numbers are vital for any small business. Numbers are how you will track every decision in your business and determine in real-time if that was a good or poor choice.

While I can’t tell you exactly what your business will cost to start, you can get reasonably reliable information by connecting with experts in your industry, talking to your accountant and doing your research.

Adjusting your start-up costs

One of the great (and scary) things about starting a business is that it’s all up to you. You have control over your business outcomes. The results are influenced by the choices and systems you set up now while you are in the start-up stage.

Have a look at your start-up costs. According to Greg Crabtree, author of Simple Numbers, Straight Talk, Big Numbers, a business should have a 10% or higher pretax profit margin each month to be successful. Do your profits outweigh your expenses? Are there any products you can add or adjust to increase your pretax profit margin?

Once you’ve identified your start-up costs, take time to play with your products and offerings. It can be a fun and freeing game to add or take away business offerings before your business becomes a reality. Adjust your numbers as if anything is possible. You’ll be surprised by what actually IS possible.

Here’s an example. Let’s say you want to open a candy store. You have lollipops and taffy as your main products. Once you calculate your start-up costs and product costs, you realize your pretax profit margin is at 7%. To raise your margin, you decide to add coffee as a product to serve the parents who are waiting for their kids to pick a candy. You discover that coffee is easy to make and low cost. This raises your profit margin to 13%. Suddenly your business is a lot more profitable!

So what can you do to make your business profitable? Don’t let those initial small business start-up costs hold you back. There is always a way!

Until next time, enjoy your Entrepreneurial Journey.

What happens after the startup stage?

Sign up for this FREE workshop to get a powerful overview of small business financials to save you money, stress and time as your business grows.